By continuing to use this website, you agree to our use of cookies to offer you personalized services and content, calculate statistics on website visits, and enable you to share content on social networks. Learn more.

A platform designed for professional and occasional investors alike

Whether you’re new to trading or a seasoned veteran, TradeDirect has the features you need to make your own decisions and invest at your pace. Our fees are among the lowest in Switzerland.

Analysis, support, and simulation tools

TradeDirect has a number of powerful features, including a portfolio simulator, analytical tools, smartphone alerts, and a market news feed. You can also access stock ratings and analyses from theScreener, an independent research firm in Switzerland.

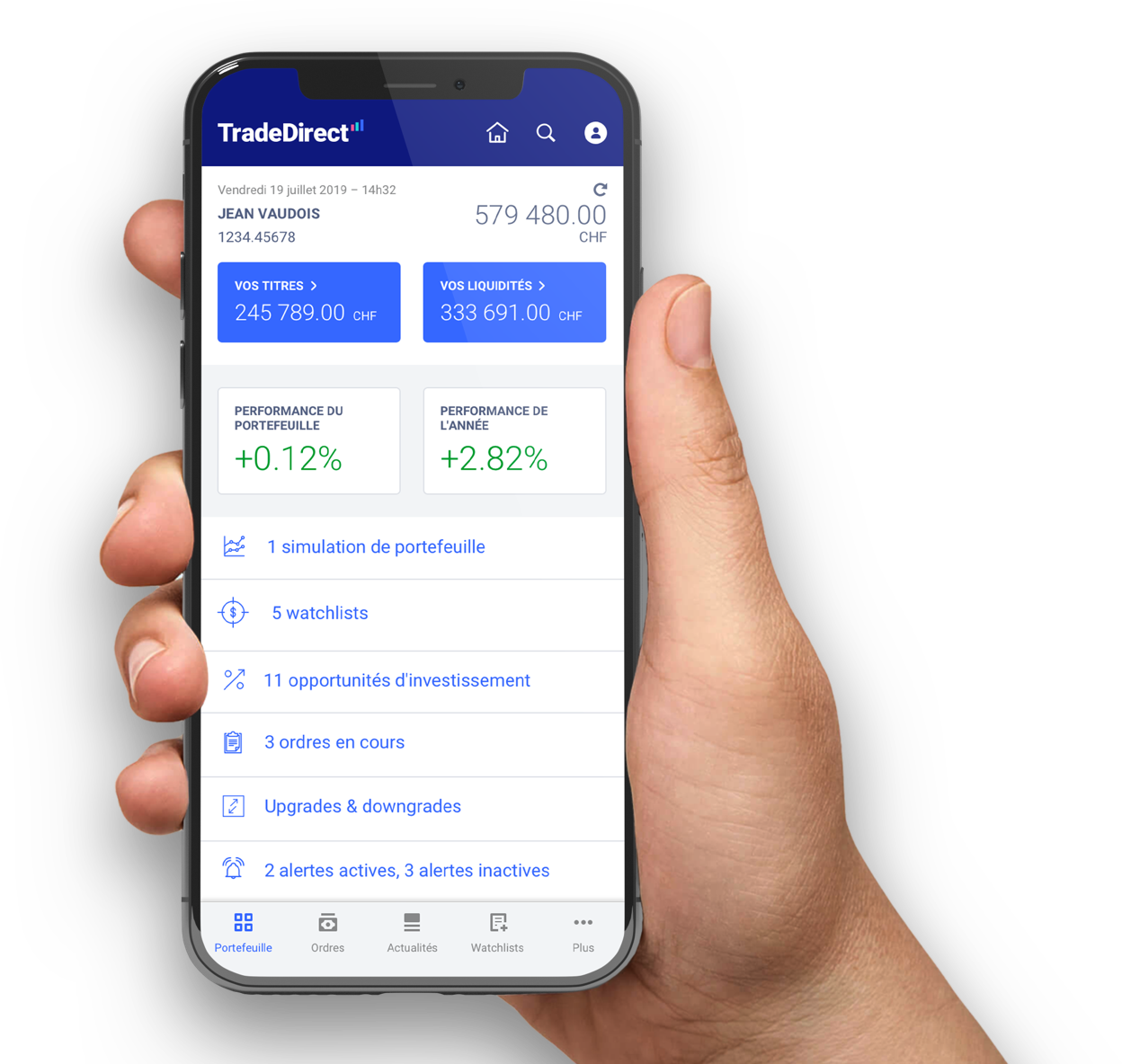

A mobile app so you’re always ready

With the TradeDirect app, it’s easy to keep tabs on the markets. You can also buy and sell stocks on your smartphone, and since every second counts, you’ll appreciate the app’s express BCV smartID authentication.

Backed by Switzerland’s second-largest cantonal bank

You know your money is in good hands with TradeDirect. That’s because in Switzerland, cash holdings are guaranteed up to CHF 100,000 per depositor per financial institution. What’s more, TradeDirect is backed by BCV, one of the few Swiss cantonal banks to be rated AA by Standard & Poor’s. You can also rely on our customer service representatives – who speak English, French, and German – to answer any questions you may have.

More than 100,000 investment products

TradeDirect lets you trade stocks in over 35 markets (including the SMI, Nasdaq, Dow Jones, CAC, and Xetra), along with all Swiss-listed warrants and structured products, 4,900 Swiss-listed bonds, and 4,700 investment funds from around the world.

- Markets accessible online

Your orders are transmitted to the stock exchanges during their official trading hours, except for Deutsche Börse AG (Frankfurt).*

SIX Swiss Exchange |

SIX Swiss Exchange, Structured Products |

SIX Swiss Exchange - Blue Chips Segment |

Swiss Fund Data AG |

NASDAQ |

NYSE American |

NYSE Arca |

New York Stock Exchange, Inc |

Xetra |

Deutsche Boersen-Indices & Xetra-ETF |

*Deutsche Börse AG (Frankfurt). Orders transmitted from 9am to 5:35pm. |

LSE London Stock Exchange |

Euronext Paris |

Euronext - Growth Paris |

Euronext - Access Paris |

Euronext Bruxelles |

Euronext Amsterdam |

Euronext Lisbon |

Toronto Stock Exchange |

TSX Venture Exchange |

Canadian National Stock Exchange |

Nasdaq Copenhagen Equites |

Nasdaq FN Copenhagen Equities - SME Small market |

Nasdaq FN Copenhagen Equities |

Nasdaq Helsinki Equities |

Nasdaq FN Helsinki Equities |

Nasdaq FN Helsinki Equities - SME Small market |

Borsa Italiana Spa, Mercato Continuo Italiano |

Oslo Stock Exchange |

Wiener Boerse AG |

NASDAQ Nordic Exchange Stockholm, Equities |

BME Bolsas y Mercados Espanoles - Renta Variable |

Nasdaq First North Stockholm Equities |

Nasdaq Stockholm Equities |

Nasdaq Stockholm Equities - SME Small market |

Prices

Our brokerage fees are much lower than those of traditional brokers. There is no minimum order amount or account balance, so you can invest the way you want. Compare TradeDirect with the competition – you’ll choose TradeDirect.

Swiss markets (1), London Stock Exchange (2) and Xetra |

US markets (3) | European markets (4) and Frankfurt Parkett (5) |

Canadian markets (6) | |

Amount |

Brokerage fees CHF/GBP/EUR |

Brokerage fees USD |

Brokerage fees EUR |

Brokerage fees CAD |

0—500 |

3.90 |

3.90 |

10.90 |

9.90 |

| 500—750 | 5.90 | 5.90 | 10.90 | 9.90 |

| 750—1,000 | 5.90 | 5.90 | 10.90 | 21.90 |

1,000 — 2,000 |

10.90 |

10.90 |

10.90 |

21.90 |

2,000 — 10, 000 |

29.90 |

29.90 |

29.90 |

32.90 |

10,000 — 15,000 |

44.90 |

44.90 |

44.90 |

44.90 |

| 15,000—25,000 | 69.90 | 69.90 | 69.90 | 69.90 |

The order entry screen shows estimated fees for the transaction in question, but they are non-binding; only the final order confirmation is authoritative. If you have any questions about fees, please contact our Customer Service Center before placing your order.

1) Fees for SIX Swiss Exchange

For unlisted investment funds, brokerage fees apply to purchases; sales are free. For certain unlisted funds, BCV’s standard fee applies. For the SIX Structured Products Exchange, the fee is capped at CHF 69.90 for orders above CHF 15,000.

2) Fees for London SETS

3) Fees for New York Stock Exchange, Nasdaq, and NYSE American

4) Fees for Euronext Paris, Euronext Amsterdam, Euronext Brussels, Euronext Lisbon, Madrid Stock Exchange, Borsa Italiana, Helsinki Stock Exchange, Nasdaq Stockholm, Oslo Stock Exchange, Nasdaq Copenhagen, and Vienna Stock Exchange

5) For Frankfurt Parkett, a fee of EUR 44.90 applies to orders between EUR 0 and EUR 15,000; for orders above EUR 15,000, the European market fees shown above apply.

6) Fees for Toronto Stock Exchange and TSX Venture Exchange

Subscription fees are waived for products issued by BCV (e.g., BCV structured products and medium-term notes). Administration fees are waived for BCV shares and reduced by 30% for BCV investment fund units and 50% for BCV medium-term notes.

For all other markets and amounts, see our full rate schedule

Want to invest?

Open a trading account now and get started within 48 hours.