Delayed quote

|

Last quote

01/16/2024 -

10:45:16

|

Bid

- -

-

|

Bid Volume |

Ask

- -

-

|

Ask Volume |

|---|---|---|---|---|

|

99.80 %

+0.30

(

+0.30% )

|

-

%

|

- |

-

%

|

- |

Master data

| Issuer | Bank Julius Baer & Co. Ltd, Guernsey Branch |

|---|---|

| Product | 8.65 BSKT/BAEG 24 |

| Domicile | GG |

| Issue Date | 07/12/2023 |

| Maturity Date | 10/15/2024 |

| Last Listing Date | 10/08/2024 |

| Issue Volume | - |

| Issue Price | 100.00 |

| Instr. Unit | Nominal (par value/face value) |

| Denomination | 1,000.00 |

| CCY | EUR |

| ISIN | CH1255578069 |

| Valor | 125557806 |

| Symbol | MBJOJB |

| Call by Holder | No |

| Call by Issuer | Yes |

Important data

| Strike | - |

|---|---|

| Ratio | |

| Instrument type | Structured instruments |

Main data

| Last | - | 10:45:16 | +99.80% |

|---|---|---|---|

| Close | - | 01/16/2024 | +99.80% |

| Day Change % | - | - | +0.30% |

| Day Change | - | - | +0.30 |

| Volume | - | - | - |

| Turnover | - | - | 499,000.00 |

| Previous year close | - | 12/29/2023 | +99.75% |

| YTD % | - | - | +0.05% |

Eusipa coding

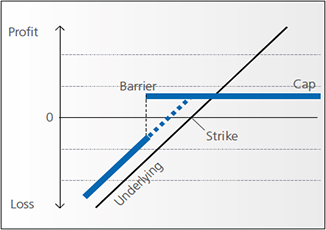

| Eusipa Category | Yield Enhancement |

|---|---|

| EUSIPA Class | Barrier Reverse Convertible (1230) |

| Product Class | 8.65% p.a. JB Callable Multi Barrier Reverse Convertible (65%) on DAX, S&P 500 Index, EURO STOXX 50 Index, Nikkei 225 Index |

|

|

Difference trading

| Open | - | - | - |

|---|---|---|---|

| Bid | - | - | - |

| Bid Size | - | - | - |

| Ask | - | - | - |

| Ask Size | - | - | - |

Difference price

| Previous Day High | 99.80 % |

|---|---|

| Previous Day Low | 99.80 % |

Interest payment

| Interest Date | 01/11/2024 |

|---|---|

| Interest | 8.65% |

| Daycount Convention | 30E/360 (ICMA) |